Description

Event Study Market Model Calculator – V1.1B

The event study market model calculator or simply, the market model calculator, is a Microsoft excel file that performs several functions and can thus provide invaluable event study help, market model help, and expected return help.

The event study market model calculator can be used to compute the different statistics for a maximum of 100 companies/securities/stocks over several time periods (days/weeks/months) around the announcement. The calculator relies on the OLS market model to determine expected returns and abnormal returns.

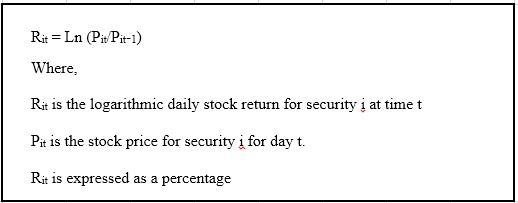

Returns (stock and market returns) are compounded and calculated using the formula (LN stands for natural log):

The calculator computes the following statistics:

- Stock returns

- Benchmark/reference/market returns

- alpha and beta coefficients

- Expected returns

- Abnormal returns

- Cumulative abnormal returns

- Averaged cumulative abnormal returns

- Average abnormal returns

- Cumulative average abnormal return

- Descriptive statistics such as standard deviations, medians, modes, minimums, maximums, and percentage of positive abnormal returns.

The easy-to-use calculator is designed for use in different event window – estimation period combinations. Using the tool, you can input and calculate data relating to a maximum of 30 companies/securities/stocks. The tool allows a maximum event window of 61 periods (days/weeks/months) [-30, +30] and a maximum estimation window of 20 to 49 periods (depending on the length of the event window). The tool can be used to both in situations where the event study begins immediately after the end of the estimation period and where there is a time gap between the end of the estimation period and the beginning of the event period.

To use the calculator, you need the stock prices for the company/securities/stock on different dates that cover your event period and estimation period. For each stock price, you also need to provide a relevant benchmark or reference index.

Limitations of the tool:

- This tool can only be used for studies based on the classic or OLS market model and does not apply for models such as market adjusted returns model, CAPM, Fama-French 3 Factor Model etc.

- This tool can only calculate statistics relating to a single event at a time (not multiple events at a time).

- This tool can only calculate cumulative abnormal returns, averaged cumulative abnormal returns, and cumulative averaged abnormal returns for symmetric event periods (such as [-1, +1], [-2, +2], [-3, +3], … [-15, +15]).

- This tool does not perform inferential tests (such as t-test to test significance from zero)

Here’s a little background to the event study market model calculator.

Reviews

There are no reviews yet.