Pestle Analysis Legal Services Industry UK Example

Introduction

Fenwick & Co. LLP is a law firm and partnership owned by two lawyers located in London’s Regent Street. Since the establishment of the firm, a number of changes have occurred in the business environment making it even more competitive. More law firms have been established in London and some have merged to form bigger corporations. In order to remain competitive, Fenwick & Co. LLP needs to analyse the external business environment with a view of identifying the measures it should take to remain competitive. The following sections of this report will discuss the political, economic, socio-cultural, technological, legal, and environmental factors of the market. The report will go further to provide recommendations that should be implemented to make the business perform better in a competitive business environment. This is a PESTLE analysis legal services industry UK example.

Political Environment

The UK has had a stable democratic government and peaceful political environment for several decades, the situation expected to remain the same in the foreseeable future. One major change in the political environment of the UK has come in the form of Brexit, which has brought a lot of uncertainty to the political environment of the country. While the full effects of a possible Brexit remain unclear to a great extent, it remains a fact that there is a strong link between the nation’s legal sector and the wider economy as well as market forces. The implementation of Brexit is likely to see the UK toughen immigration laws for citizens of the European Union, making it difficult for them to live and do business in the country. Currently, the country provides virtually unrestricted access to foreign firms from about 40 jurisdictions to establish and practice law within its borders (TheCityUK, 2016b). This may change depending on the outcome of the ongoing negotiations between the UK and the EU revolving around Brexit. As a result, many foreign companies in the legal sector are likely to withdraw from the UK which may effectively create opportunities for emerging law firms like Fenwick & Co. LLP (The Law Society, 2015). In spite of the current political situation facing the UK, English and Welsh law remain the choice of law internationally.

According to TheCityUK (2016b), the UK is the leading international market for legal services in the world as well as the leading international centre for resolving disputes. Coupled with this is the fact that Wales and England (together) is the jurisdiction of choice for many international organisations (The Law Society 2016). Given that Fenwick & Co. LLP has foreign employees who are nationals of European Union countries, Brexit may lead to the loss of such employees or changes to their working conditions. Furthermore, Brexit may mean the loss of business for Fenwick & Co. LLP which serves customers across different EU countries on family matters and domestic conveyancing among other areas of law (The Law Society, 2015). This may be the case given that current and potential foreign customers may withdraw from the nation due to the implementation of tougher immigration policies and policies regulating foreign workers, which no doubt will affect the legal services industry.

Economic

Value of the Legal Industry

In 2016, legal activities contributed between £24.4 billion and £25.7 billion to the economy of the UK (The Law Society, 2016; Ullah, 2017). The legal services sector also contributed to trade activity in the country by amassing exports worth approximately 4.1 billion pounds (Ullah, 2017). Coupled with the need by companies in UK’s cities for legal advice on various issues, the growth in regulations has seen a sharp increase in the demand for the services of solicitors, most of whom have established in cities. The growing demand for legal services especially in cities has seen the number of solicitors increase by roughly 60% over the past decade (The City UK, 2016a).

Legal services activities are closely tied to financial service activities. For many financial services to be offered, certain enabling legal services such as contract development, deal structuring, dispute resolution, and broader advisory services are required. The high demand for legal services from financial services was highlighted by a report published by The Law Society. According to the report, the share of demand for financial services stood

at 17% (or £2.8bn) of total business demand; over three times the demand from the second largest external source (the construction sector) which accounts for 5% of total business (£ 919 million) (The Law Society, 2016). Given that Brexit is likely to have an impact on the financial services sector, there are fears that by extension, Brexit could have implications on legal services revenue (Ullah, 2017).

According to projections by The Law Society of England and Wales (2017), lower growth in the UK economy will more likely be reflected in lower growth in disposable incomes for households. It is projected that real disposable income for households will increase by a paltry 1.8% in 2018 and 2.2% in 2019 (The Law Society of England and Wales, 2017). These, together with relatively high house prices (and subsequently a ditch in housing

transactions), will likely lower growth in demand for legal services from the personal consumer sector.

Economic Growth

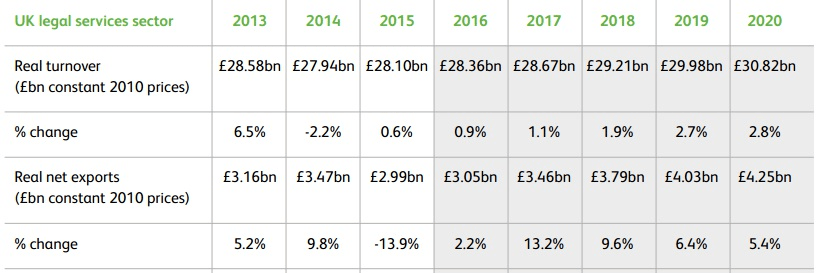

According to The Law Society (2016), the legal services sector has grown by an average of 3.3% every year for the last 10 years, even outstripping economic growth which has averaged 1.2%. Legal services net exports have grown by on average by 5.6% per annum over the past decade to reach £3.6 billion in 2016 (The Law Society 2016). Between 2014 and 2015, the total value of the legal services sector grew by 8% according to The Law

Society (2016). According to The Law Society of England and Wales (2017), growth in UK legal services sector between 2017 and 2018 will be modest with real turnover for 2020 reaching £30.82 billion as evidenced by figure 1. Between 2019 and 2020, it is projected that the sector will achieve growth rates of at least 2.7% per year.

Fig. 1 UK legal services sector Forecasts Source: The Law Society of England and Wales

Socio-Cultural

There is a growing trend among UK nationals to try and reduce legal costs. In this regard, many potential clients seek to complete legal tasks on their own as a way of reducing overall costs. Many of them are unwilling to pay for information that is already easily available or documents that are traditionally made from scratch (Invicta, 2017). Although technology is a source of competitive advantage for firms providing legal services, it has also contributed to loss of business as clients have increased access to free legal information online. According to Invicta (2017), 80% of the population found ways of solving legal problems without having to secure the services of a lawyer. Many of them rely on blogs, portals, or cloud computing to access the legal information they require. Another trend among UK nationals is their preference for predictable fees when seeking legal services. This trend is prompted by the need to avoid paying exorbitant fees commonly witnessed when fees are billed hourly.

Yet another social trend among UK nationals is their preference for companies that engage in ethical practices and invest in corporate social responsibility activities. A recent survey by the Chartered Institute of Marketing revealed that 81% of millenials (those aged 18-34) wish that companies commit to corporate social responsibility values publicly (Chartered Institute of Marketing, 2018). The study also revealed that 92% of millenials preferred to buy from companies that committed to ethical business practices. Yet again, the study revealed that 73% of millenials would not mind paying extra for sustainable offerings. Another study conducted by the Association of Accounting Technicians (AAT) revealed

that 70% of consumers have their purchasing decisions influenced by the ethical behaviour of a company (Association of Accounting Technicians, 2016). The study revealed that 43% or those surveyed counted tax avoidance as a vital factor in deciding whether or not to engage with a company. The study further revealed that other factors consumers consider important when choosing a company with which to engage include a strict ethical code

with respect to the company’s supply chain, maximum transparency with respect to company accounts, and being careful with sensitive customer information (Association of Accounting Technicians, 2016). These findings indicate that transparency, ethical practices, engaging in best practices, and corporate social responsibility have an impact on purchasing decisions and consumer loyalty.

Technological

Like in other sectors, technology is perceived to be a source of competitive advantage in the UK legal services sector. It is for this reason that players in this sector are seeking more relevant technologies for use in delivering services (Deloitte 2016). Law firms in the UK are fast adopting modern ways of doing business. Statistics show that over the years, use of ICT to procure or offer services has steadily grown among UK nationals (Office of

National Statistics, 2015). Some law firms in the UK are already going paperless as a way of reducing costs (Law Technology Today, 2015). The law firms are also using practice management software to schedule their activities and manage their resources for greater efficiency. As a way of reducing the risk of losing important information, many businesses

are opting to store their data on the Cloud (Law Technology Today, 2015). By backing up data on the cloud, businesses are assured of having their information back in the event that the printed or soft copies they have locally are intentionally or accidentally destroyed or lost.

The advent of social media has transformed the way business in the legal services industry market themselves and interact with current and potential customers. Many businesses in the sector today have an online presence both in the form of a website or on social media which help them reach and respond to clients’ needs in faster and more effectively. In general the Internet and social media have helped reduce the costs businesses have to occur in marketing their products and in communicating with clients and potential clients. They have also made communication more efficient and effective.

Many regulated law firms currently appreciate the importance of having an online presence through websites and social media. As a result, many legal firms already have websites and social media pages or are in the process of developing them. With the wide and growing use of mobile phones and Internet technologies, many legal firms are using or have already developed mobile applications. According to Kimtasso (2018), 24 percent of the top 300 law firms in the UK already have mobile applications on the public app stores. Some of the applications most used by law firms include client support apps, interactive tools, content marketing apps, event apps and general firm apps (Kimtasso, 2018).

According to the Office of National Statistics (2015), close to 93% of adults in the UK own and use a mobile phone, which means marketing, advertising and providing services using mobile applications and websites is likely to be effective in reaching potential clients. With many individuals, businesses and organisations expecting to receive services even outside traditional office hours, Do-it-Yourself (DIY) online solutions are more and more

gaining ground in the provision of certain legal services such as will writing and divorce (Solicitors Regulation Authority, 2014). Regulated lawyers note that the development of online services has greatly contributed to the growth of their businesses (Solicitors Regulation Authority, 2014). Statistics indicate that over the next five years, use of online legal services will increase from 28% to 37% even as 40% of consumers indicate that they are willing to use low cost online legal services given that they also offer convenience (Solicitors Regulation Authority, 2014).

Some of the technologies likely to disrupt the legal services sector in the UK include artificial intelligence, mobile applications and automated document management (Thompson, 2018). These technologies are perceived to be crucial investments for law firms as they have the potential to reduce costs and improve efficiency in service delivery in a market where the customers demand cheaper and faster legal services. Some of these technologies, especially artificial intelligence, are extremely expensive and may only be afforded by well-established legal firms with heavy financial muscle (Thompson, 2018).

According to Solicitors Regulation Authority (2014), technology firm IBM is currently working with several legal organisations to develop and improve several artificial intelligence applications for the legal profession. Although artificial intelligence applications have so far not found much use in the legal services sector currently, they have great promise and could easily attract great rewards for firms which pioneer in their usage. In view of the importance of technologies as a source of competitive advantage, legal firms such as Fenwick & Co. LLP need to adopt different technologies and communication tools that are increasingly becoming available.

Legal

According to some experts, Brexit will inevitably bring changes in the legal environment and will, therefore, create demand for advisory services across all areas of law for both private and corporate clients (Lexis Nexis, 2017). Compliance as an area of practice is likely to benefit from Brexit as companies and individuals engage in the process of adjusting to a new regulatory environment (Lexis Nexis, 2017). Some practice areas are,

however, likely to be negatively affected as law firms will face the difficult task of becoming ready for the implementation of Brexit (Lexis Nexis, 2017). According to some experts, corporate and M&A are some of the practice areas that may suffer moving forward due to Brexit as companies and individuals focus on divesting or relocating their operations to Europe in the wake of a changing economic climate (Lexis Nexis, 2017). Whether Brexit assumes a hard or soft shape, the process of adjusting to the environment is likely to be characterised by a long-term period of change.

With Brexit being a reality, there are concerns that UK lawyers may not be able to freely practice across European Union member states (Ullah, 2017). At the same time, there are concerns that it may affect the ability of law firms to recruit skilled staff from European Union countries. With possible restrictions on the recruitment of foreign talent occasioned by tougher immigration requirements, the legal services sector is likely to suffer short-term skills shortage which in turn may see a significant increase in labour costs and immigration-bureaucracy related costs for law firms (Lexis Nexis, 2017). In spite of these potential changes, the United Kingdom is likely to remain a leading destination for international businesses to carry out their legal affairs, more so given their preference for English Law, as well as due to the good reputation of the UK for its highly trained and

skilled English judges (Ullah, 2017). Considering these factors, law firms such as Fenwick & Co. LLP need to take active steps towards adjusting themselves in line with the dynamic policy environment characterised by Brexit.

Environmental

In the UK, the commitment to engage in ethical practices and corporate social activities has emerged to be a sources of competitive advantage for companies as consumers tend to prefer the products of companies that publicly engage in such practices and activities (Association of Accounting Technicians, 2016; Chartered Institute of Marketing, 2018). On the other hand, businesses that are not committed to such practices and activities are

viewed more unfavourably by consumers. In the legal services sector, consumers view companies that offer a wide range of pro bono (free) legal advice with more favour than their counterparts that are only interested in making profits (Slater Gordon, 2018). According to a recent study involving the top 100 law firms in England and Wales, companies that had lower ranking were more likely to be those that little engaged in CSR activities (University of Birmingham, 2017).

Conclusion and Recommendations

The UK has a stable political environment which is good for the business. While the implementation of Brexit is less likely to disrupt the political stability of the country, it has certainly brought a lot of uncertainty with regard to the future of the legal services industry. In this regard, law firms need to prepare themselves to quickly adapt to changes that may be brought about by Brexit. There are high possibilities, for example, that many foreign owned law firms may withdraw from the UK market which may effectively reduce competitive pressures on law firms owned by locals. At the same time, there are possibilities that the industry may lose a sizeable portion of its market if the UK implements tough immigration laws, effectively locking out many EU citizens from the UK.

- The UK legal services industry has achieved steady growth (on average,

3.3%) over the past decade. It is projected that the market will grow by 2.7%

annually between 2019 and 2020 to achieve a value of £30.82 billion. These

statistics indicate that the market promises growth for the industry and is,

therefore, economically favourable for Fenwick & Co. LLP.

- Given the political and economic situation of the UK currently, small law

firms such as Fenwick & Co. LLP should put more effort in targeting

organisations compared to individual consumers. This measure is informed by the fact that the UK is the jurisdiction of choice for many international

organisations and remains the leading international centre for resolving

disputes. The measure is also informed by the fact that projections show little growth in the demand for legal services from the personal consumer sector and increased demand for legal services from financial services going by past and current trends.

- With many people preferring predictable legal fees so as to avoid exorbitant

fees, Fenwick & Co. LLP should change its pricing structure from billing

customers hourly to fixing more or less standard charges for every kind of

work.

- To appeal to more clients, the business should also engage in ethical practices and inexpensive corporate social activities such as providing some legal services free of charge. The company should also market itself as a company that is extremely careful with sensitive customer information.

- With many clients and potential clients seeking legal information and service providers online, Fenwick & Co. LLP should have in place a website and social media pages. The company should strongly market itself through social media and using mobile applications to reach a much wider audience than it is currently reaching. This is based on the fact that over 90% of adults in the UK own and use a mobile phone.

- With a projected increase in demand for affordable, online legal services

(from 28% to 37%), the company should produce and offer virtual and

downloadable products and sell these online, through its website, in an

automated process.

- To reduce costs and improve efficiency, the company should go paperless by

making use of technologies such as automated document management and

practice management software. At the same time, the company should invest in cloud computing technologies to ensure the safety of its information. Yet again, the company should consider investing in artificial intelligence technologies which although extremely expensive, can afford it competitive advantage over other players in the market.

References

Association of Accounting Technicians (2016). Majority of consumers say purchasing decisions are influenced by ethical behaviour of company 12 September https://www.aat.org.uk/news/article/majority-consumers-say-purchasing-decisions-areinfluenced-ethical-behaviour-company

Chartered Institute of Marketing (2018). The case for CSR/ Sustainability Reporting Done Responsibly [online]. Available at: https://sustaincase.com/chartered-institute-ofmarketing-uk-millennials-love-csr/ [Accessed 22 June, 2018].

Deloitte (2016). Future Trends for Legal Services Global research study. London: Deloitte. [online]. Available at: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Legal/dttl-legal-futuretrends-for-legal-services.pdf [Accessed 22 June, 2018].

Invicta (2017). What will affect the solicitors’ profession in the next twelve months? [online]. Available at: https://invicta.law/insights/see-major-policy-legal-regulatory-issueslikely-affect-solicitors-profession-next-twelve-months/ [Accessed 22 June, 2018].

Kimtasso (2018). Legal market research – Mobile apps in law firms 2017[online]. Available at: http://www.kimtasso.com/mobile-apps-in-law-firms/ [Accessed 22 June, 2018].

Law Technology Today (2015). How Lawyers Will Modernize Their Firms in 2015 [online]. Available at: http://www.lawtechnologytoday.org/2015/02/modernize-law-firms-

2015/ [Accessed 22 June, 2018].

Lexis Nexis (2017). Law firms of the future—preparing for Brexit, [online]. Available at: https://blogs.lexisnexis.co.uk/futureoflaw/2017/10/law-firms-of-the-future-preparing-forbrexit/ [Accessed 22 June, 2018].

Office of National Statistics (2015). Internet Access – Households and Individuals: 2014. London: Office of National Statistics.

Slater Gordon (2018). Corporate Social Responsibility [online]. Available at:

https://www.slatergordon.co.uk/about-us/corporate-social-responsibility/ [Accessed 22 June, 2018].

Solicitors Regulation Authority (2014). Research and Analysis: The Changing Legal Services Market. London: Solicitors Regulation Authority [online]. Available at: http://www.sra.org.uk/risk/resources/changing-legal-services-market.page [Accessed 22 June 2018].

The City UK (2016a). The Impact of Brexit on the UK-based legal services sector, The City UK

The City UK (2016b). UK Legal Services 2016 [online]. Available at:

https://www.thecityuk.com/research/uk-legal-services-2016-report/ [Accessed 22 June, 2018].

The Law Society (2015). The EU and the Legal Sector. London: The Law Society of England and Wales.

The Law Society (2016). The Economic Value of the Legal Services Sector. London: The Law Society of England and Wales [online]. Available at:

http://www.lawsociety.org.uk/news/documents/legal-sector-economic-value-final-march-2016/ [Accessed 22 June, 2018].

The Law Society of England and Wales (2017). Legal services sector forecasts 2017-2025. London: The Law Society of England and Wales. [online]. Available at: https://www.lawsociety.org.uk/support-services/research-trends/legal-services-sectorforecasts-2017-25/ [Accessed 22 June, 2018].

Thompson B. (2018). Deloitte muscles in on legal services in UK. Financial Times. January 10 [online]. Available at: https://www.ft.com/content/fa38f3c8-f54a-11e7-88f7-5465a6ce1a00 [Accessed 22 June, 2018].

Ullah S (2017). The value of the UK’s legal services sector and its importance to the City’s economy [online]. Available at: http://colresearch.typepad.com/colresearch/2017/07/thevalue-of-the-uks-legal-services-sector-and-its-importance-to-the-citys-economy.html [Accessed 22 June, 2018].

University of Birmingham (2017). Large Law Firms and Corporate Social Responsibility [online]. Available at: https://www.birmingham.ac.uk/schools/law/research/spotlights/corporateresponsibility.aspx [Accessed 22 June, 2018].

Pages 1-6