Copper Lead Aberdeen Harbour Sediments

Here is a preview of the paper on Copper Lead Aberdeen Harbour Sediments.

Copper and Lead Levels in Aberdeen Harbour

1.0 Introduction

Anthropogenic activities are recognized as a significant contributor to the build-up of heavy metals, such as lead and copper in urban areas and marine settings, posing health risks to people’s lives and the lives or marine organisms (Yan et al., 2018; Briffa et al., 2020). Exposure of humans or marine organisms to these pollutants can result illness, poor health, or even death (Briffa et al., 2020). Lead, a well-known poison for centuries, is a subject of global public health regulations and is linked to miscarriages, brain damage, kidney damage, cancers, and even death in humans (Tchounwou, et al. 2012; WHO, 2024). Although naturally present in soils at low concentrations, studies indicate a gradual increase in environmental lead concentrations due to human activities (WHO, 2024). Copper, essential for enzymatic activity at low concentrations, acts as an enzyme inhibitor at higher levels, causing diarrhoea, vomiting, and liver disease in humans (Tchounwou, et al. 2012; Ashish et al., 2013).

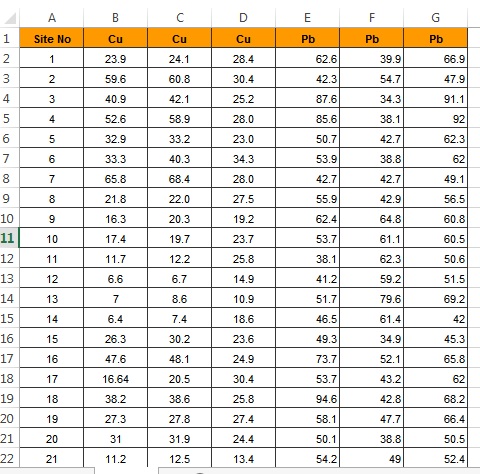

Harbours, due to shipping activities, often experience severe marine pollution (Onwuegbuchunam et al., 2017; Zhang, 2020; Shahzad, 2023), leading to a rapid decline in water and sediment quality, impacting fish and marine life significantly. Unlike some pollutants, heavy metals cannot undergo biodegradation and may accumulate in sediments to toxic levels over time (Tchounwou, et al. 2012). According to the Marine Management Organisation (2015), marine sediment concentrations below 50mg/kg (dry weight) for lead and below 40mg/kg for copper fall under Action Level 1 (AL1), indicating safe levels (Appendix 1).

Situated in Aberdeen City, Aberdeen Harbour, is recognized as one of the oldest and busiest ports in the United Kingdom (Ship Technology, 2018). Handling approximately 8,000 vessels annually, the harbour contributes over £1.5 billion to the national economy by managing nearly five million tonnes of cargo (Ship Technology, 2018). The cargo, including industrial chemicals, pesticides, oil, and liquefied gas, poses a potential risk of pollution. Additionally, other sources of heavy metals entering the harbour include construction, domestic, industrial, and agricultural activities, as well as chemicals and wastes. Continue Reading (Alternative 2) …

Here are some words that can be used to describe the paper:

Aberdeen harbour baseline study example

Aberdeen harbour sediments study

Aberdeen Harbour Baseline Survey

Aberdeen Harbour Baseline Survey for Environmental Status

Copper and Lead Levels in Aberdeen Harbour Sediments

Copper Lead Aberdeen Harbour Sediments

Sample data

1. What are the shared resources and capabilities shared by the separate Virgin companies? – common resources and capabilities Virgin companies.

1. What are the shared resources and capabilities shared by the separate Virgin companies? – common resources and capabilities Virgin companies.

You are working in the management accounting department of ABC which manufactures a range of consumer electronics products. The current range comprises 50 different products and the company launches around 10 new products every year.

You are working in the management accounting department of ABC which manufactures a range of consumer electronics products. The current range comprises 50 different products and the company launches around 10 new products every year. Nationalism has been defined by Breuilly (2001) as political movements that seek or exercise state power and justify their actions based on nationalist arguments. It has also been defined by Hutchinson and Smith (1994) as an ideology based on the premise that a person’s commitment and loyalty to the nation state supersedes other personal or group interests. According to Breuilly (2001), three main assertions are ascribed to nationalism. The first claim is that a nation exists if it has a well-defined and distinctive personality. The second assumption is that the nation’s interests and values take precedence above those of the individual and organizations. The final assertion is that the nation must be as free as possible from the domination of other nations, governments, or entities.

Nationalism has been defined by Breuilly (2001) as political movements that seek or exercise state power and justify their actions based on nationalist arguments. It has also been defined by Hutchinson and Smith (1994) as an ideology based on the premise that a person’s commitment and loyalty to the nation state supersedes other personal or group interests. According to Breuilly (2001), three main assertions are ascribed to nationalism. The first claim is that a nation exists if it has a well-defined and distinctive personality. The second assumption is that the nation’s interests and values take precedence above those of the individual and organizations. The final assertion is that the nation must be as free as possible from the domination of other nations, governments, or entities. The involvement of experts in courts to provide expert testimony is not a new practice. As far back as the Middle Ages, physicians, sea captains, and other experts have been called on to help or testify in English courts when the facts of the case were so complicated that the judge or jury did not have adequate knowledge to make a decision (Essig 2002). Before the 18th century, judges and juries actively took part in gathering and presenting evidence, and experts often served as official advisors to courts or juries. When the legal system underwent the adversarial revolution in the 18th century, however, this situation changed as judges and juries took on more passive and neutral roles in the collection and presentation of evidence. Consequently, litigants took active charge of gathering and presenting evidence in a structured forensic setting (Essig 2002). This change saw the role of experts in courts change from being (impartial) court advisors or members of the jury to being partisan witnesses (Eigen 1995; Watson, 2006). In their roles as partisan witnesses, the experts faced a myriad of challenges which they sought to overcome through different means. This paper seeks to compare and contrast the challenges facing psychiatric and toxicological expertise in the nineteenth century “Adversarial Courtroom”, and the strategies they adopted to legitimate their knowledge.

The involvement of experts in courts to provide expert testimony is not a new practice. As far back as the Middle Ages, physicians, sea captains, and other experts have been called on to help or testify in English courts when the facts of the case were so complicated that the judge or jury did not have adequate knowledge to make a decision (Essig 2002). Before the 18th century, judges and juries actively took part in gathering and presenting evidence, and experts often served as official advisors to courts or juries. When the legal system underwent the adversarial revolution in the 18th century, however, this situation changed as judges and juries took on more passive and neutral roles in the collection and presentation of evidence. Consequently, litigants took active charge of gathering and presenting evidence in a structured forensic setting (Essig 2002). This change saw the role of experts in courts change from being (impartial) court advisors or members of the jury to being partisan witnesses (Eigen 1995; Watson, 2006). In their roles as partisan witnesses, the experts faced a myriad of challenges which they sought to overcome through different means. This paper seeks to compare and contrast the challenges facing psychiatric and toxicological expertise in the nineteenth century “Adversarial Courtroom”, and the strategies they adopted to legitimate their knowledge. This article attempts to answer the following questions:

This article attempts to answer the following questions: